How often have you heard messages like “to be the best bank for customers” or “legendary customer service is at the heart of our business strategy”? That’s great, and imperative as the lines blur between Big Tech, Retail, Telco and Banks.

Back in the real world,

Banks are well down the CX league tables. For example, the average NPS score for European banks is 15-20 points lower than that for supermarkets*.

Most CX leaders typically face the question, “How do you protect the customer experience when costs are being cut?” I’d argue that the right question is, “What is good customer service worth?”

Without an answer to this question, then CX leaders must make do with whatever budget they can scrape together, and hope they are able to improve the customer experience within it.

Do not despair!

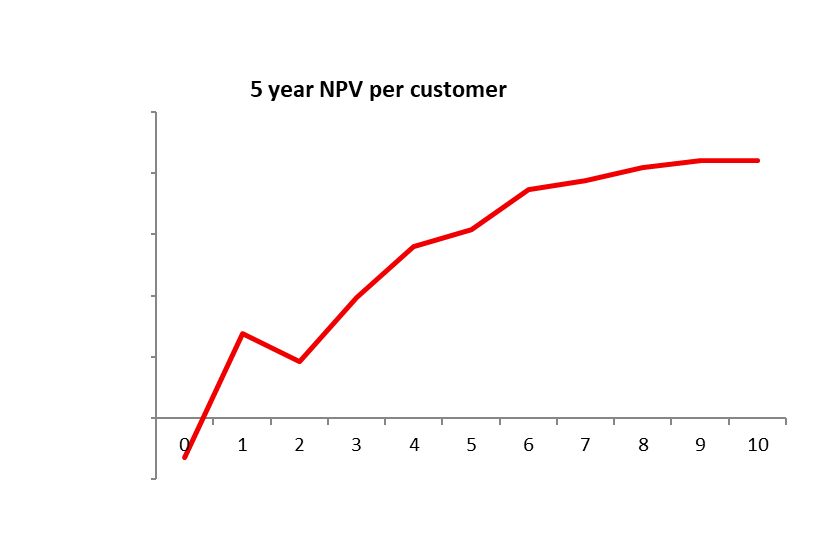

The role of analytics in CX is long-established but specifically addressing the cumulative and incremental value of that experience has often been overlooked – although not by everyone, as you can see from this example from a major Utility:

This relationship between NPV and customer experience (measured here by Net Promoter Score, NPS) allowed the Board to understand the return from moving from second-to-last in the league to first place. Plans and the necessary budgets followed to achieve that goal. And it did work, although history reveals this is a battle that does not stay won!

Interestingly, this picture also suggests that there is not really a great justification for seeking excellence, which makes sense – fabulous electricity is not any different from the other sort! This picture does differ by industry and customer segment.

Of course, this is only a high-level answer which might garner support for a programme but doesn’t really support individual initiatives. Using a measure like NPS, we need to be able to understand the drivers of changes. This analysis needs to cast the widest possible net – important drivers can be surprising.

I worked on a project for a major hospital a few years ago and their biggest CX driver for in-patients was….

not the quality of the surgeon. No one wants to think their surgeon is anything other than good, so unless they are actively awful (which is thankfully rare) then this has no impact. It was also not the caring qualities of the nursing staff or cleanliness of the facilities for similar reasons. No – it was the food.

Many hospitals skimp on food quality and choices for patients or the delivery process to bring it hot and appetising to the bedside – small investments in this area yield disproportionate impacts… even if hospitals are not really looking for repeat visitors!

What do we need to drive insights like this for banks? I would identify six key capabilities:

- Integrated data

- Temporal analytics

- Customer profitability

- Propensity modelling

- Journey analytics

- Board KPIs

Integrated data is the first requirement, and that should be as broadly-based as possible (like meal attributes for that hospital) to discover the unexpected. Agility in connecting to potential data resources and exploring them in temporary lab environments is key.

We also need to undertake

temporal analytics – interventions can yield different outcomes depending on the sequence, timeliness and magnitude of the event, as we try to avoid the “it’s a bit late to be sorry” outcome. That leads us to the inevitable task of trying to anticipate negative impacts through use of predictive analytics, which need to be connected to operational processes for execution.

Customer profitability measures are also critical – these need to be forward-looking (NPV) and recognised by the CFO to ensure business cases are acceptable. Intervention-based “what-if” analysis requires a lot of supporting analytics like

propensity to buy and churn modelling as inputs.

All these activities should be using the same data – there is no business case for building lots of point solutions if cost control is to be delivered.

Customer Journey analytics are probably already on the shopping list of any CX leader, but this should be reviewed to ensure it can deliver operational change at scale and directly impacts on the experience, not just process failure reduction. I would observe that the loan application process is working correctly when poor risk customers are declined, but that this intended outcome has negative CX impact that might need to be addressed for some customer segments.

Finally, don’t forget to build the measurement and monitoring into core Board KPIs. Aggregate customer NPV is something that can and should be tracked back to experiences customers receive and can come close to the total enterprise value of the Bank.

* Source: Temkin Group

(Author):

Stewart Robbins

Stewart Robbins is responsible for providing expertise within the Financial Services sector and in defining strategic data and analytics capabilities within banking, delivering business-focused support to all dimensions of projects. He brings subject matter expertise in the areas of Analytics Consulting, Data Science, Customer Insight, Predictive Modelling, and CRM in presales, solution development and delivery activities.

Stewart has extensive client-side and consulting experience in the design of analytic capabilities and delivering measurable value through data discovery and analysis. Whilst Stewart has past hands-on experience of data science, he is also an experienced leader of such teams and programmes of activity. He has helped senior business leaders develop their analytics visions with detailed supporting strategies and roadmaps.

Prior to joining Teradata, Stewart was an analytics consultant at Hewlett Packard (now DXC Technology) and spent 25 years as an analytics practitioner and leading analytics teams at E.ON Energy, Barclays Bank and Nationwide Building Society.

Stewart is a graduate of University College London with a BSc in Economics and Geography and is also an Associate of the Chartered Institute of Banking.

View all posts by Stewart Robbins