The transformation of the automotive industry over the last few years has been extraordinary. Taking electrification as just one example -- the rapid movement of electric vehicles from niche market to mainstream, and soon, core product – has highlighted the ability of leading players to rapidly pivot their entire organisations. The COVID pandemic has further illustrated both the fragility of some established processes, and the ability of the industry to flex and overcome challenges with agility. But there is more to come! The never-ending march of technology and its impact on the very nature of what automotive products are, how they are used, developed, built and operated over their lifespan will continue to disrupt the industry. So too will the closely associated changes in business model. The way revenues are earned, products designed, produced, marketed, sold and supported continues to evolve at pace. Today’s automotive businesses are rapidly moving from structured business-to-business hierarchies to fluid networks of partners that continuously interact with customers.

Weaving multiple digital threads

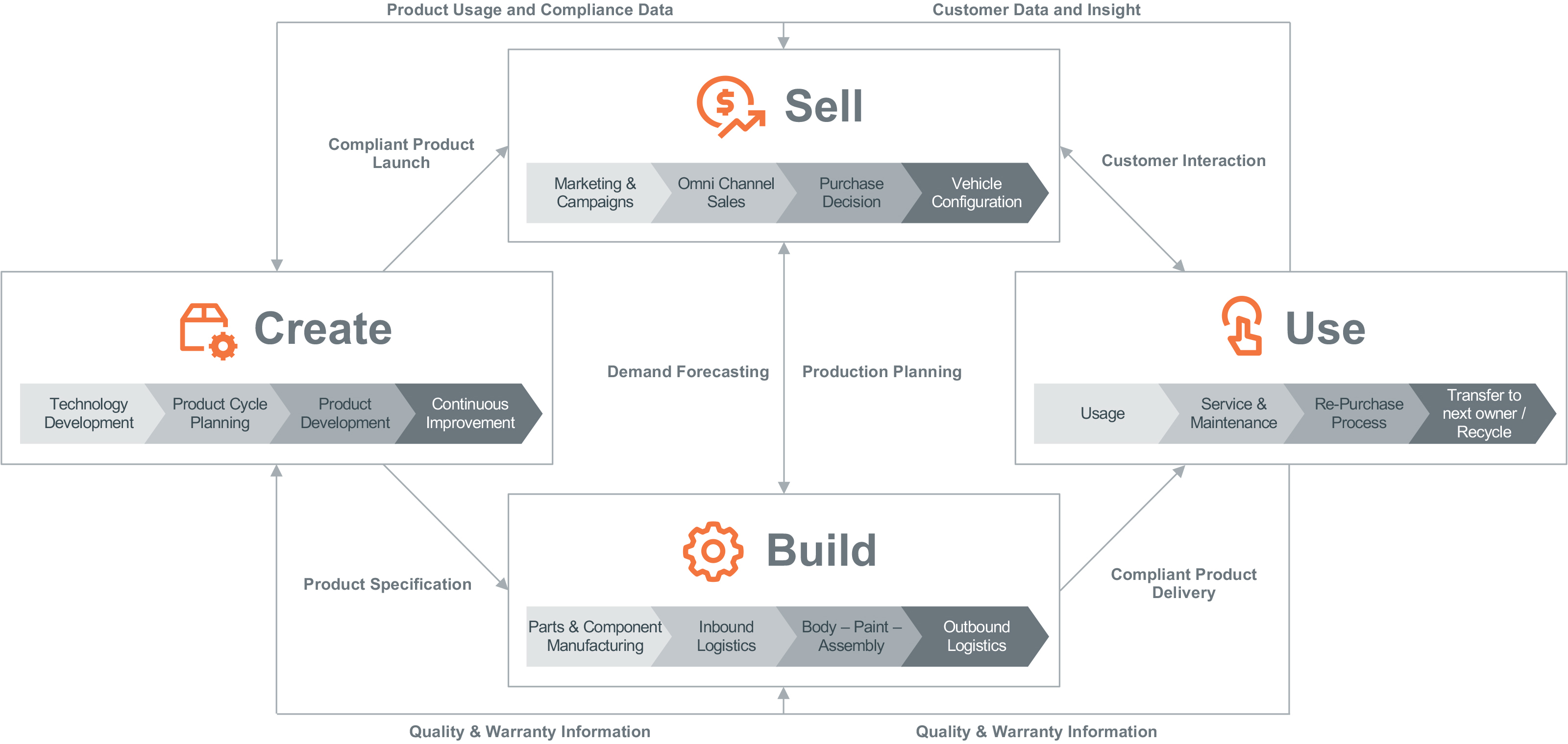

As we’ve outlined previously, data sits at the heart of all of these shifts. Automotive businesses, just like organisations in every other sector, must quickly evolve to become truly data-centric. Establishing, nurturing and pulling on the digital threads that connect data from customers right through to product innovation linking every aspect of the lifecycle of a vehicle will be critical. The complexity of the challenges, plus the demand for data at unprecedented speed and scale means that the automotive company of the future will need to weave multiple digital threads into a consistent and coherent digital fabric that connects an entire ecosystem.

Many automotive OEMs, and tier one suppliers, have already created ‘Islands of Excellence’ where digital threads connect key processes and ensure data flows back and forth to add value. For example, several Teradata customers are using data and machine learning to rapidly identify quality problems in the factory and in the fleet. Automation of root-cause analysis further improves quality processes. Others are using connected car data and situational analytics to drive tailored messages to drivers, and several are using marketing analytics to identify high value customers and reduce churn. The next step is to connect these islands into contiguous continents of data. It is a long journey to reach this land, but every step in creating a digital fabric will have immediate value add.

Answering questions not yet asked

A key benefit of beginning to weave this digital fabric has been keenly demonstrated by the disruptions of the past couple of years. Siloed, proof-of-concept approaches to analytics can deliver some value, but time and again businesses find they need answers to new questions. Models and approaches specified to answer the previous set of questions are always falling behind as new unexpected ones emerge. The digital fabric takes a different approach by seeking to connect all data and prepare it to be combined however needed to solve as yet unforeseen problems and deliver unimagined insights. Volkswagen has taken bold steps as a leader in creating a digital platform for production. Working with AWS it has implemented the Digital Production Platform to combine data from all machines, plants and systems from all its facilities to create and support an industrial ecosystem of internal and external innovation to improve manufacturing processes. Teradata is part of this initiative to create a digital fabric and provides one of the first live cloud-based analytics providing 100% process monitoring for continuous improvement.

Three Prerequisites

Working to create this digital fabric we’ve identified three essential prerequisites for automotive businesses. The first is granular data. In marketing terms, we talk about the segment of one – tailoring offers to the exact need of every individual customer. In automotive terms it means tracking, tracing, predicting and mitigating down to every individual part number for inbound logistics. It means managing manufacturing and outbound logistics at individual VIN number level. Data needs not only to be collected from individual vehicles, owners and drivers throughout the lifecycle of the product, but in a usable format that can be analyses to drive value at every point.

The second prerequisite is to shift from a mindset that sees data as an output, or even by-product of a process, useful for reporting, to an understanding of data as input and output that drives predictive models. Deploying data to automate, de-risk and prevent issues, as well as to provide insights into new opportunities, reduces costs and increases value. Using data to understand why something went wrong is powerful – using it to predict and avoid problems from occurring is transformational.

Finally, automotive companies must lay the groundwork for the massive scale and speed of data needed to thrive in the future. Here’s why. An average vehicle might have 20,000 parts, each of which can be subject to many events (i.e. raw materials used, time and place of manufacture, shipment details etc.), all of which create data - let’s say 100 data points before main assembly. That’s already 2 million events per vehicle. Multiply that by the number of vehicles manufactured by each factory each year and suddenly there are hundreds of millions of events to capture! As the business model changes, and OEMs continue to capture and use data from fleets in use for the lifetime of the vehicle and the numbers increase by at least another magnitude.

Start Now!

Building a digital fabric is not a simple or fast process, but it is important to start to conceptualize current and future data projects in this way. Preparing the enterprise data analytics foundation that can scale to the demands outlined above is crucial. So is establishing the governance and approach to ensure that analytics projects begin to form a portfolio of models that are reusable and leverage proven features plus connected data from across the enterprise. We’ve worked with leaders across the industry to create solutions that deliver rapid time to value, and act as essential building blocks of the digital fabric. Over the coming weeks we’ll explore these in a series of blogs. In the meantime, if you want any further insights on the digital fabric and how we can help you build it, please

email our industry team.

(Author):

Monica McDonnell

Monica McDonnell is a highly experienced consultant in the field of enterprise software, digital transformation and analytics. Her career has spanned Africa, the US and Europe with time spent on ERP and supply chain planning before focusing on delivering value from data. Monica advises on how to deliver business value by combining good data governance and advanced analytics technologies. Helping automotive companies understand how to release the full potential of Industry 4.0 technologies, and dramatically improve customer experience management as enabled by the connected vehicle is central to her role. Monica earned a BSc in Industrial Engineering from the University of Witwatersrand, and a MSc in Software Engineering from Oxford University.

View all posts by Monica McDonnell

Sr. Industry Consultant with a strong focus on the automotive industry. Robert has been with Teradata since August 2017 and joined from the Volvo Group where he spent 13 years in a number of roles, predominantly within Product Strategy and Planning for Trucks, Powertrain and the former Aerospace business unit. Robert was lastly responsible for the Volvo Group long term roadmap for heavy duty trucks as well as leading a team of senior product planners delivering strategic investigations and project pre-requisites. During his time at Volvo Group, he was also deeply involved in formulating strategies and business models related to connectivity, automation and electromobility. He has a wide experience from commercial vehicles, as well as from passenger cars based on spending 9 years within product planning, product development and as a business process manager within General Motors prior to joining the Volvo Group.

View all posts by Robert Widell