In short, no. Thanks for stopping by the blog. See you next time.

But wait! As always, we need to consider whether this is a “glass half empty” or “glass half full” situation.

Most CFOs and their finance departments remain application driven – so whenever a new requirement for reporting and analysis arises, they sit down to develop a specific solution addressing the requirement (i.e. IFRS 15 – Revenue Recognition etc.).

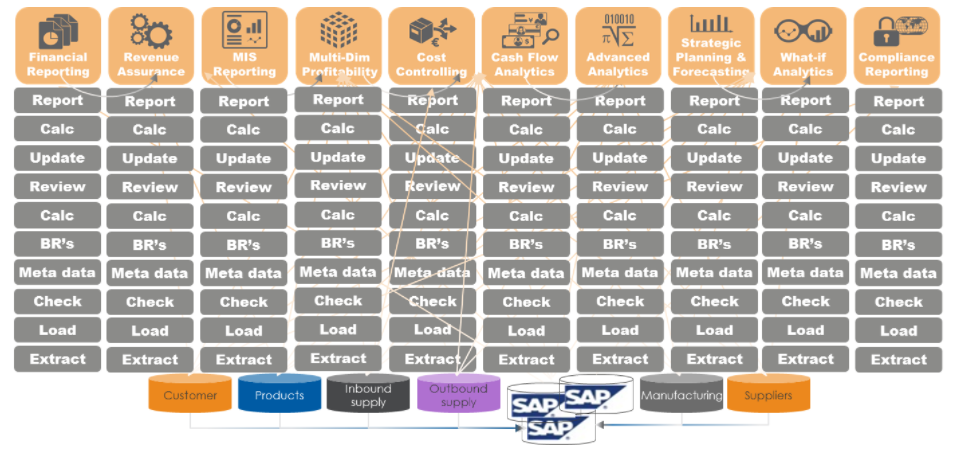

It’s one thing to design/develop the new solution to support the reporting requirement, but the majority of CFOs and their finance departments completely forget the related and additional steps that are necessary to actually deliver the new reporting requirement. The below is by no means and exhaustive list of steps, but it gives you some idea of the scale of the problem:

- New data extracts (extract, transform, load)

- New data reconciliation steps

- New metadata

- New business rules

- More reconciliation steps

- New semantic models (for output)

- Review of the data

- Increased likelihood for changes (i.e. data looks wrong => new data request or similar)

- Final update

- Ready for consumption (distributed to relevant stakeholder)

As the observant reader now realises, most of these steps are exactly what finance departments are already doing when preparing other reports and analyses – as you can see from the following graphic:

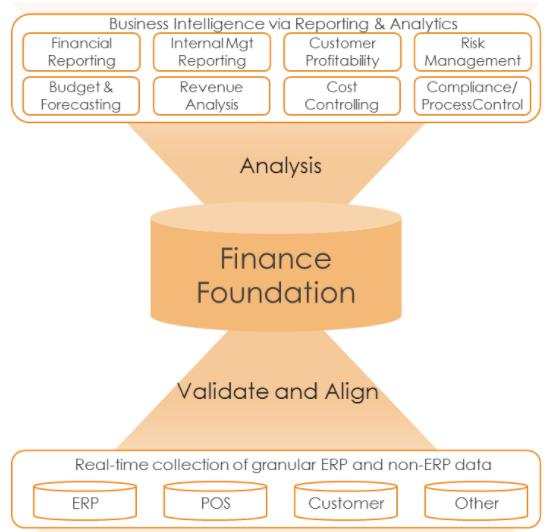

Now that I’ve complained a bit about the lack of ‘vision’ at CFO level and across the finance department, I must emphasise the fact that a few organizations globally have seen the light, moving away from the application driven mentality. These companies have developed a finance foundation based on enterprise resource planning (ERP) and non-ERP data at the most granular level. It looks something like this:

The benefits of being a data driven finance department are huge, especially in these three areas:

- Analytics: Multi-dimensional profitability solutions based on ABC principles become the foundation of every type of report and analysis

- Data quality: Significantly improved because the establishment of the finance foundation shines a light on the areas in need of improvement when, for example, updating operational systems, issuing a PO or SO etc.

- Speed: Data for reporting and analyses is available in real-time. Data ‘massaging’ is also automated, with the ability to drill through (of course, aligned with security profiles)

And finally, the killer argument: all reports and analyses reconcile with the general ledger and any other data source that has been used.

Creating a finance foundation begins with re-establishing the joins between ERP and non-ERP data, which have a direct relationship. Those joins, incidentally, were removed when non-ERP data was converted or transformed into ERP data. You may wonder how that could possibly be the case, and the simple and sorry answer is this: if the two weren’t linked, the ERP system would crash. ERP systems are meant for automating manual processes related to Purchase-to-Pay, Order-to-Cash, Make-to-Order, etc., not for detailed reporting and analyses.

Activity based costing principles for revenue/cost data should be dynamically applied via identified cost/value drivers.

The result is a finance foundation capable of addressing all reporting and analytical needs in and around the CFO department – making it possible to view and analyze any relevant dimension related to profitability (i.e. customer, product, service, event etc.) – and in parallel use the same data for other types of reporting and analytics.

Glass half full

Because some CFOs and their finance departments are actually moving in the right direction; shifting from the application driven mentality, and instead becoming data driven, the metaphorical transformation glass, it would seem, is very much half full and slowly filling.

Bookmark this blog to keep up with future topics including: tangible and intangible benefits; how to start your analytics journey; what not to do with data; and why CFOs have been slow to adopt a data driven approach.

(Author):

Michael Ingemann

Michael Ingemann is the Practice Partner of CFO Analytics across Industries at Teradata EMEA. Michael has more than 30 years of experience working in the CFO space. He started out as an Auditor and then moved into Finance Director positions (Airline and Oil and Gas industries). For the past 20 years Michael, has acted as a senior advisor for many CFO’s and Finance departments across industries.

Below are samples of the projects and experiences Michael has delivered throughout his career;

- SAP and Oracle ERP implementations

- Enterprise Performance Management solutions (e.g. Financial Consolidation and Reporting, Budget & Planning and Forecasting)

- Activity Based Costing Solutions

- Customer and Product Profitability solutions

- Finance Transformation projects

Michael holds a BSc in Financial management and a Executive MBA in General mgt & business development – both obtained CBS in Copenhagen.

View all posts by Michael Ingemann