More precise targeting of digital payments products and features drives revenue and profit

The holy grail of the credit card business is “top of wallet” status. How to achieve that is the subject of decades of analytics work. Now, more than ever before, this is achieved with

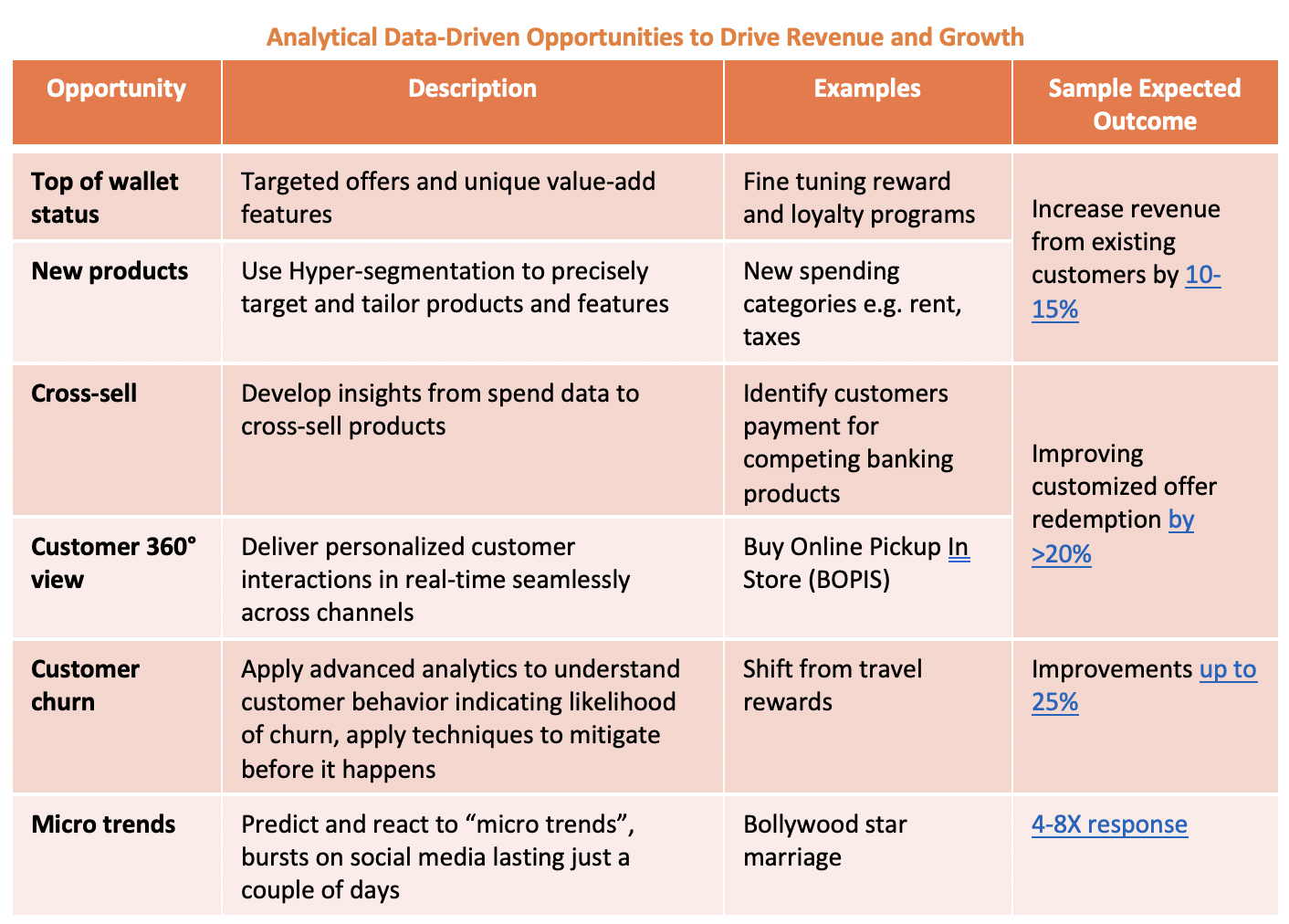

hyper-segmentation, personalized interactions across channels and optimizing rewards programs in REAL TIME. Payments data drives opportunities for product innovation to increase usage and prevent attrition.

Top of Wallet

Top of wallet status is primarily driven by precisely targeted, personalized offers and unique value-added features. According to

McKinsey, this can increase revenue from existing customers by 10-15%. This is combined with “hyper-segmentation” to identify profitable discrete segments of even single individuals. PayPal says that it uses data to customize customer and merchant experience into

277 million unique segments. From these segments, the need for new products and spending categories, such as rent and taxes, can be identified.

Companies are developing insights from spend data to cross-sell other banking products. For example, identifying customers paying for competing financial services products, and then making a more attractive offer. This, with the elusive “Customer 360° view, improves customized offer redemption by more than 20%, according to

Mastercard.

The Challenge of Changing Consumer Preferences

In today’s environment, consumer preferences are changing rapidly. Who would have anticipated a year ago that “Buy Online Pick-up In Store” would become the trendy if awkward acronym BOPIS? Those players who can deliver personalized customer interactions in real-time seamlessly across channels and apply advanced analytics to understand customer behavior indicating likelihood of customer churn in REAL TIME will be ahead of their competitors.

For

example, reimagine the customer journey of getting a new credit card using data and mobile, meeting expectations set by Big Tech -- Apple and Amazon. Apply for a card and be approved in just a couple of minutes, use the card immediately because it is instantly provisioned into the mobile wallet, understand spending by enriching transaction data, enabling control with sophisticated alerts and controls and anticipate needs and guide activity in moments of tension, convenience and delight, like geolocation offers. Together these features reduce the abandonment rate of applications, lower chargebacks and customer service calls and decrease fraud.

A recent example is fast reaction to attractiveness of rewards programs. A study from

Mercator Advisory Group reveals that 135 million credit card accounts in the U.S. are at risk of attrition – travel rewards cards with an annual fee. Companies with renewable analytics will uncover changing consumer behavioral trends faster – conferring a competitive advantage to react in time.

Identifying Micro-Trends with Analytics

Finally, analytics can be used to identify micro-trends on social media, many lasting as little as a few days. The ability of Artificial Intelligence to create a marketing campaign “at lightning speed,” aligned to the micro-trends resulted in four to eight times superior response,

according to Mastercard. Their example was a marketing campaign in India tied to the marriage of a Bollywood star.

Teradata’s Customer Journey Analysis uses payments data to gain insights into strategies that drive marketing effectiveness. Examples of journeys include abandoned online purchases, credit card spending, path to purchase, and multi-channel customer demand. Sales and Revenue Analytics helps to understand the factors which affect revenue, including complex behavioral drivers. See more at “

Teradata Customer Journey” and “

Advanced Retail Analytics.”

Precise Targeting of Digital Payments

All these examples – top of wallet, new products, cross-sell, customer 360° view and more – drive improvements in a company’s critical business outcomes like revenue, profit, rapid product introduction, spend lift, retention and customer engagement. With the value, volume and velocity of payments data, financial institutions realize significant incremental value. Based on the example of a model credit institution with $30 billion in income, just a 1% improvement in customer churn, cross-sell / up-sell and new customers results in an incremental annual revenue of more than $60 million constituting 31 basis points improvement, and increased profit of nearly $30 million constituting five basis points improvement.

Precisely targeted digital payment products and features, “Top of Wallet” status with Hyper-segmentation, personalized interactions across channel and optimized rewards programs. These are the payoffs from massive amounts of payments data. This data “fuels” the ability to drive customer value, leverage data gravity and create a virtuous circle in the emerging smart financial services enterprise ecosystem.

In our next post, we will explore how analytics enables rapid response to changing customer preferences.

Deborah Baxley is an international mobile/cards payment consultant, recognized expert in the industry, creator of growth strategies for new and existing markets with more than 20 years’ experience consulting to cards and payment companies. She specializes in retail financial services, mobile payments, credit cards, technology strategy and business model development. Through her work in fifteen countries, she has advised issuers, acquirers, fintechs, networks and processors on product direction and competitive positioning, delivering millions of dollars in new revenue or operating cost savings.

View all posts by Deborah Baxley