Gartner recently published this year’s

Digital Marketing Hype Cycle, 2020 with “Customer Journey Analytics” and “Real-Time Marketing” both at the

Peak of Inflated Expectations. Inevitably, these two CX use cases will move into the

Trough of Disillusionment as impatience for results and failure to deliver expected financial returns set in. This blog profiles early adopters for both Customer Journey Analytics and Real-Time Marketing who overcame initial hurdles and realized superior business outcomes. By learning from these pioneers, you can reduce risk and accelerate value for your digital marketing initiatives.

Real-Time Marketing

The relevancy and fit of offers delivered through a bank’s digital channels has a direct impact on the revenue that they are able to generate and the experience that their customers have when making transactions or accessing information online. During a major digital transformation, the retail banking division of a large, multinational conglomerate recognized that they needed accurate, granular and complete digital customer data to underpin much of their decision making and execution needs. Transactional and offline customer data were already available to them; however, the richer digital data would enable them to build optimal models and power real-time, cross-channel personalization needed to maximize customer acquisition, engagement and cross-selling.

In particular, they needed to understand a customer’s interests in greater depth, identify any stalling points in the customer journey while tying together online behaviors and transactions across all channels and devices at the individual customer level in real-time. The organization wanted to be able to offer the same type of highly personalized customer service and sales experience online and across-channels as they did through physical contact in-branch.

The solution included:

- A critical 360-degree customer view that included branches, websites, applications and ATMs.

- A real-time recommendation engine that used machine learning with inputs from real-time customer behavior data and historical integrated data (see first bullet).

Executed highly personalized communications via their own website and through social networks (e.g., Facebook) and search engines (e.g., Google).

Customer acquisition is now 3-5 times more effective overall than before for the same level of investment. Credit card conversion significantly improved for both the online (from 16% to 30%) and mobile channels (from 27% to 82%).

Real-Time Marketing Keys to Success:

- Start small with one use case in one real-time channel. The above use case initially focused on credit card conversion on their website. This builds momentum and provides key learnings required to scale.

- Get your data foundation in order. Without a fairly complete picture of the relationship with your customer, real-time marketing only delivers blunt or disjointed messages faster.

- Deploy a real-time engine based on machine learning, not rules. Today’s environment is too dynamic to try and keep pace through developing and maintaining rules for every scenario. Today’s machine learning algorithms learn and adjust to evolving customer preferences.

Customer Journey Optimization

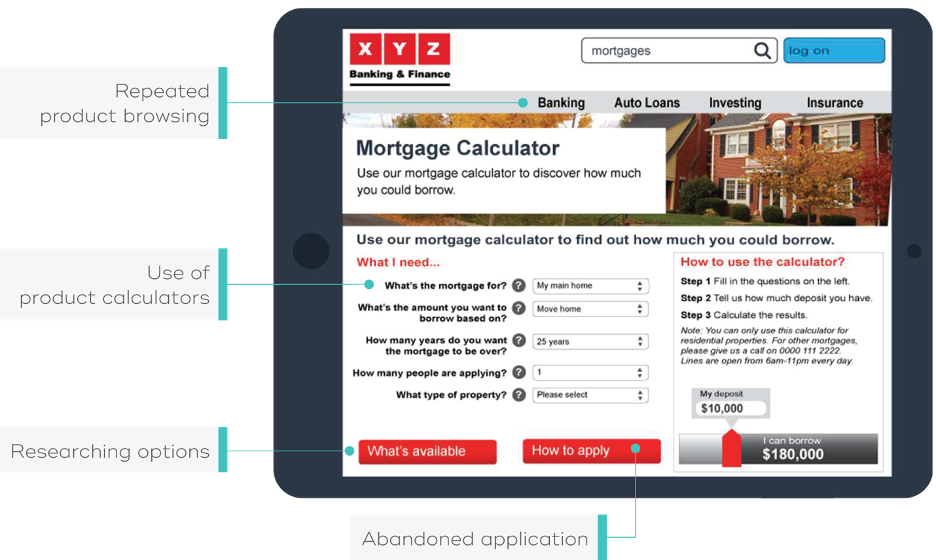

Since today’s leading financial institutions feature a vast and complex array of digital channels, diagnosing issues with the online performance of digital pages or processes can be challenging, resulting in many serious imperfections to digital channels remaining invisible to organization for many months or even years. A top 5 global financial services firm recognized they experienced a critical disadvantage in the effectiveness of their customer journey in online service processes. With a lack of digital customer data, stalling points weren’t easily recognized or addressed. Customer data was siloed. There was insufficient analytic tooling to make sense of the data they did have, and web data was simply not granular enough.

The solution included:

- Identity resolution to connect web, mobile app, and offline customer data.

- Derived new digital variables such as page scores, recurring visits, duration, and others.

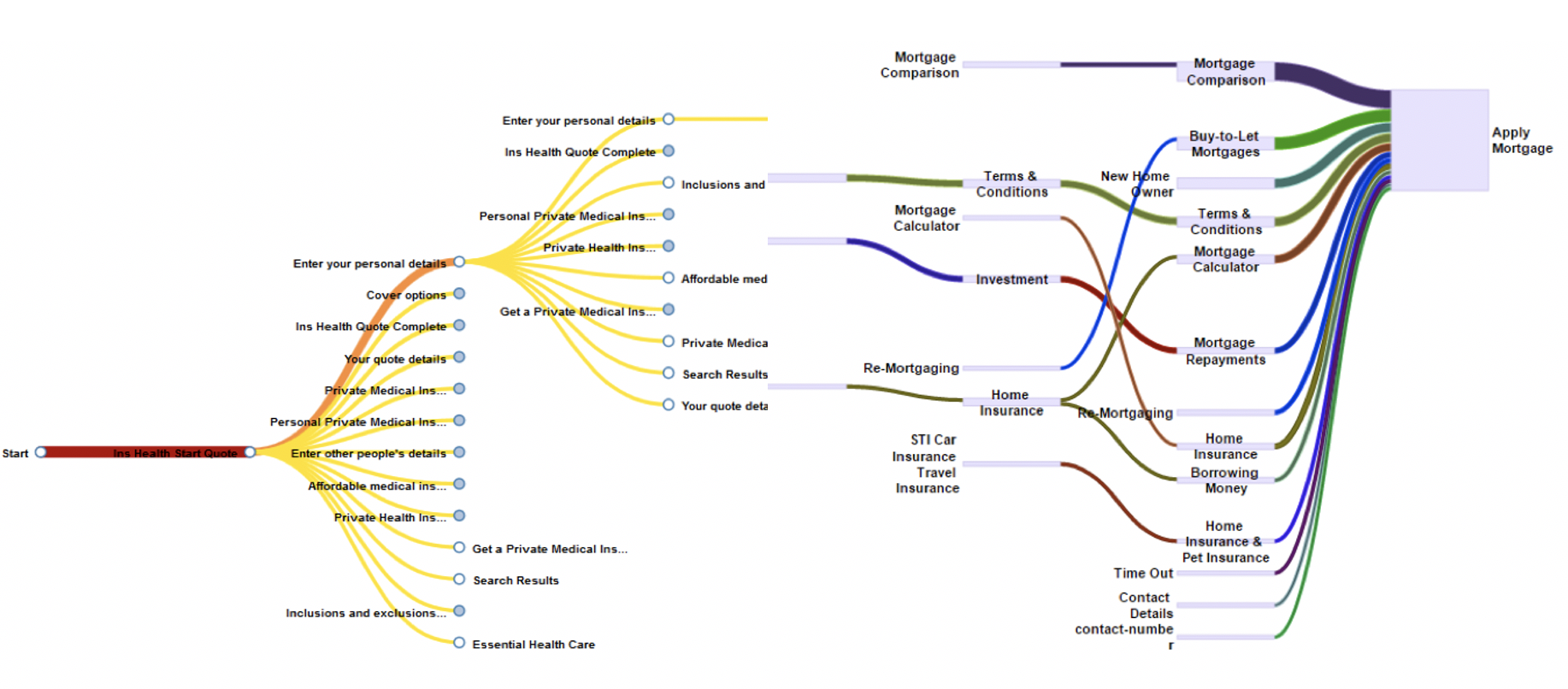

- Path analytics to visualization and uncover opportunities across multiple touchpoints.

- Triggered hyper-personalized communications to improve experiences and remedy customer pain points.

The interactive visualizations enabled analysts to quickly query the funnels to find new insights. Analysts would sit down with their business partners and interactively discuss findings and identify solutions. The organization was also able to establish closed loop reporting that enabled better learning and enhanced performance management. In one instance, an 80% drop out rate on one process was tracked to a single form field that was repaired. In addition, simple design issues with a loan calculator were identified, corrected a repetitive loop that affected 50% of users. The bank realized $50m in incremental profit in the first year after launch and a 50x increase in click through rate (CTR) for personalized messages.

Customer Journey Analytics Keys to Success:

- Get your data foundation in order. Without visibility across all customer touchpoints, journey maps will be incomplete.

- Bypass manual journey mapping based on perceptions of the customer journey. Instead, let the data and analytics tell the story. Journey maps informed by actual customer data across all customer touchpoints are the only way to derive accurate and revealing insights.

- Journeys in large enterprises can be complex, necessitating intuitive, drillable visualizations that illustrate the steps and customer counts along the way.

Resources:

New research from CMO Council covering where Marketers get stuck on real-time marketing and customer journey optimization, and the best practices and countermeasures to realize value.

Check out this Vantage CX demo to see Customer Journey Analytics and Real-Time Marketing in action.

Gartner, Hype Cycle for Digital Marketing, 2020, July 2020

Chad Meley is Vice President of Solutions Marketing at Teradata, responsible for Teradata’s Artificial Intelligence, IoT, and CX solutions.

Chad understands trends in machine & deep learning, and leads a team of technology specialists who interpret the needs and expectations of customers while also working with Teradata engineers, consulting teams and technology partners.

Prior to joining Teradata, he led Electronic Arts’ Data Platform organization. Chad has held a variety of other leadership roles centered around data and analytics while at Dell and FedEx.

Chad holds a BA in economics from The University of Texas, an MBA from Texas Tech University, and performed post graduate work at The University of Texas.

Professional awards include Best Practice Award for Driving Business Results in Data Warehousing from The Data Warehouse Institute and the Marketing Excellence Award from the Direct Marketing Association. He is a regular speaker at conferences, including O’Reilly’s AI Conference, Strata, DataWorks, and Analytics Universe. Chad is the coauthor of the book Achieving Real Business Outcomes From Artificial Intelligence published by O'Reilly Media, and a frequent contributor to publications such as Forbes, CIO Magazine, and Datanami.

View all posts by Chad Meley